Market Analysis for Week 38 – Wednesday

Indexes are at key levels, NVDA, TSLA, UBER, TSM, and BYD are looking like perking up to the buy point today, the market looks healthy.

Note:- “Understanding the overall market trend is crucial before analyzing individual stocks. If the market is trending downward, it’s unlikely that individual stocks will perform well. Therefore, assessing the broader market behavior is important before focusing on specific stocks. I rely on a few key indicators to gauge market trends, which guide my decision on whether to invest or hold cash. I assign a percentage score to each of these indicators, and the combined score determines how much of my capital I will allocate to the market.”

Summary of Market Analysis (100% Uptrend)

- Corporate Bond (HYG) – Confident (20%)

- Nasdaq 100 Power Shares (QQQ): (20%)

- IBD 50 ETF (FFTY): (20%)

- At least 100 New Highs Today out of 8000+ U.S. Socks: 171: (20%)

- US New High Stocks: 171 exceeds New Low Stocks: 94: (20%)

Corporate Bond (HYG): (20%)

The corporate bond ETF is performing strongly and appears to be overextended. Looks a little exhausted on the top.

Nasdaq 100 Power Shares (QQQ): (20%)

The Nasdaq is performing strongly and is above the fast 13 EMA and the slow 48 EMA.

QQQ is bouncing up trying to break out of the 485.50 range this is the second attempt, let’s see how it plays out.

IBD 50 ETF (FFTY): (20%)

The IBD 50 is performing strongly and is above the fast 13 EMA and the slow 48 EMA. There is no change in IBD 50 looking like it will be exhausting soon.

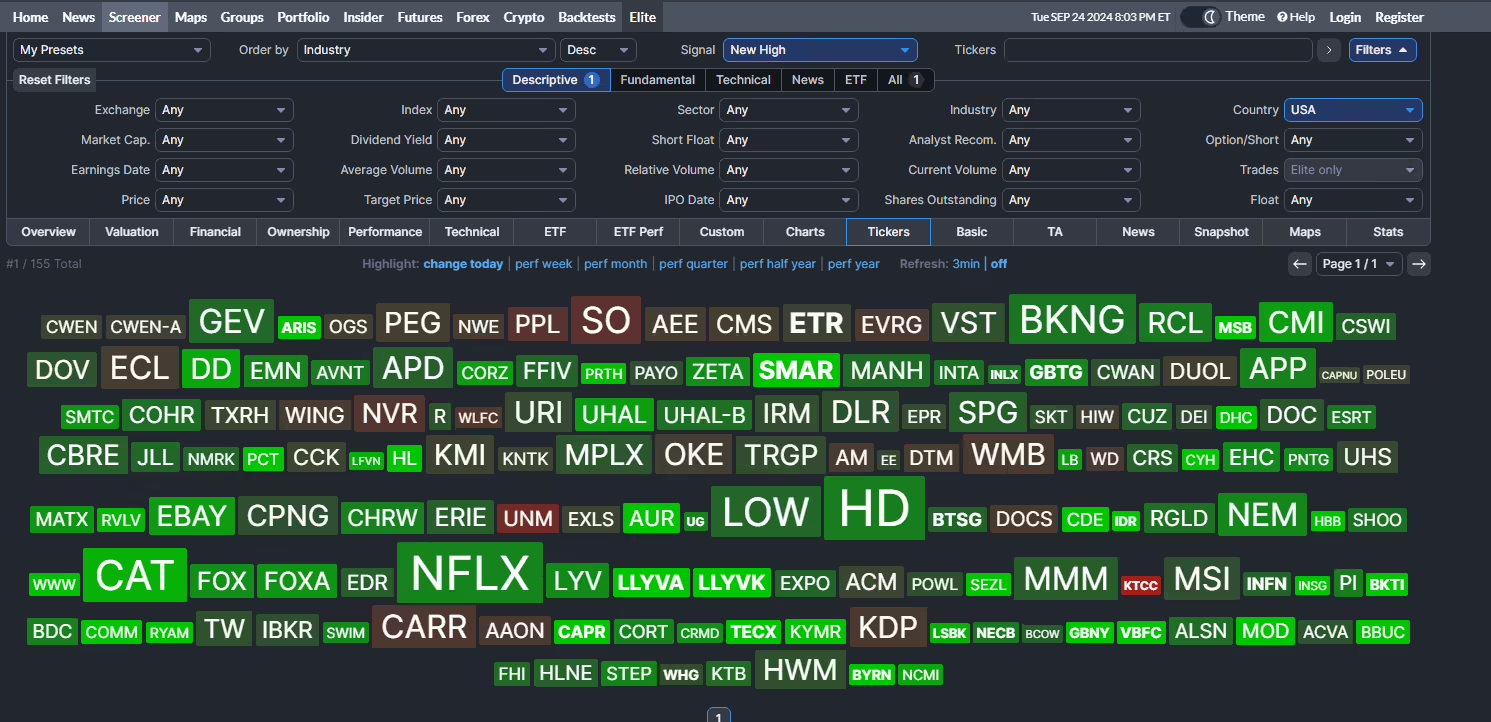

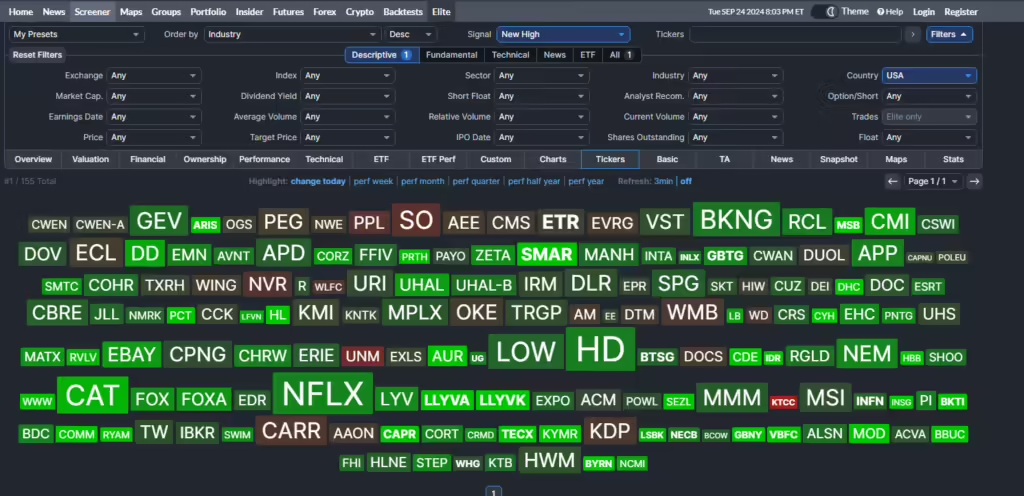

At least 100 New Highs Today out of 8000+ U.S. Socks: 171: (20%)

US New High Stocks: 171 exceeds New Low Stocks: 75 : (20%)

New Highs: 155

New Lows: 75

Key Stocks – Stocks on Radar

Please Subscribe to my Substack (https://substack.com/@rprateek) for daily key stocks on my radar and screenshots of my entries and exits.